Token market making is a process of creating liquidity for tradable tokens on an exchange. It is a crucial part of any successful crypto project. A successful token market can be defined as one that creates a positive feedback loop with network ownership effects, or as a token that is pegged to a real-world asset.

Tokens must have value to be valuable on the market, and token makers need to understand what value a particular token provides. This value may be in the form of a App, or it could be in the form of life-changing healthcare solutions or even the removal of a middleman during transactions.

The value of a token is directly related to the demand for it, and a lack of demand for a token can cause it to plummet in price. This is why it is so important for token makers to carefully consider their strategy and marketing approach.

Table of Contents

Good Crypto Market-Making Practices are a Combination of the Following Strategies:

1. The Good

Crypto market makers employ several techniques to ensure that they maintain a healthy liquidity level for their tokens. These include:

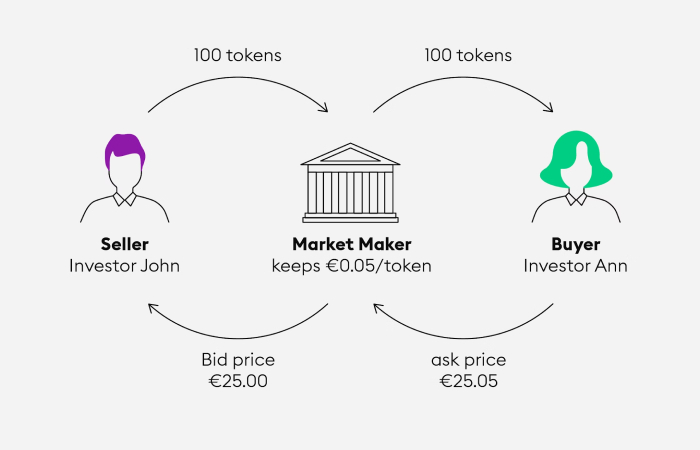

2. Keeping a Consistent Spread

A market maker that is efficient at maintaining a consistent spread will be able to generate more profits for themselves than one that is not. They will also be able to maintain liquidity in their bots, which is essential for their business operations.

3. The Bad

Crypto market makers have a number of potential risks they need to take into consideration. Some of these include volatility in the underlying assets, counterparty risk, liquidity risk, and regulatory risk.

These risks can be mitigated by using hedging and risk management protocols, and by adapting to changing market conditions.

4. The Ugly

One of the most common crypto market making practices involves ramping up the value of a token by buying large amounts in a short period of time. This tactic can be dangerous and could result in a sudden decline in the token’s value.

It can be difficult to spot these tactics as they are often subtle and can be done in a variety of ways, from creating phantom buyers to front-running traders. However, it’s important to be aware of them in order to protect yourself and avoid being a victim of scammers.

5. The Bad

Ramping is a market making tactic that involves creating an impression of a big buyer by buying large amounts of the token in a short period of time, often in a single transaction. It can be a very manipulative tactic and can drive up the price of a token by creating an impression that there is an active, reputable buyer who is willing to buy large amounts at a low cost.

This can be a great way to get ahead of the curve, but it can be dangerous as well. As with any other form of trading, there is always the possibility of losing money, which can be devastating for a crypto market maker. This can remain avoided by using the right strategies and making sure to monitor your market maker’s performance.