Table of Contents

Introduction

EPFO – 2023: The Employees Provident Fund Organization (EPFO) is a tribute form that supports Central Board in managing the required Provident Fund Scheme, Pension Scheme, and Insurance Scheme for the workforce engaged in the organized sector in India. So, users can check their PF balance, Increase claims, Apply for UAN, Check their claim status, apply for a Jeevan Pramaan certificate, and other services using this app.

What to do if EPFO has not yet Processed the Claim for Payment of a Higher Pension?

- The deadline to apply to the Employees’ Provident Fund Organization (EPFO) to opt for a higher pension is June 26, 2023. Suppose you’ve already used it but haven’t received any updates from EPFO

- In that case, sending a reminder is essential as an expert advises that the study of applications for claiming an advanced pension and the validation of joint options are experiencing significant delays at field offices.

- “If the pensioners have not heard anything from the concerned local office of the RPFC, it is open to them to send a reminder to the said Authority to expedite the processing of their claim and take further action for payment of higher pension following the judgment of the Supreme Court in the case of EPFO vs. Sunil Kumar B, decided on 4.11.2022,” stated B C Prabhakar, Advocate, and President of Karnataka Employers’ Association in a circular shared on June 6.

- The EPFO has told field officers to validate the joint option application within 20 days of its receipt without any delay.

- An EPFO circular issued on April 23 stated that the field office would examine applications and joint options for higher pension. “The joint option uploaded by the pensioners as well as employers has not managed by the respective Field Officers of the EPFO,” said Prabhakar.

What is EPF and? How to Calculate PF Balance?

On the assessment of the progress made by field officers, it found that the study of applications for demanding higher pension/validation of joint option prolonge in Field officers. And also, they have discussed the matter at the EPFO Head Office level, which Secretary, Labour, and Employment controlled.

As an employee working in a company set-up, there are numerous things one would like to know about the Employee Provident Fund (EPF). EPF is the main scheme under the Employee Provident Funds and Miscellaneous Provision Act 1952. The Employees’ Provident Fund Organization (EPFO) protects the system. Therefore, it covers every establishment where 20 or more people are employed. Also, specific organizations are protected, subject to certain conditions and exceptions, even if they use less than 20 persons each.

How to Access Your EPFO Passbook Online?

You can access your EPFO passbook online through the EPFO website or mobile app. You will need your Universal Account Number (UAN) and password to ensure this.

Is there any Financial loss to EPF Members due to the Delay in Updating Interest in the Member Passbook?

- The date on which the claim entered into the passbook of the member has no genuine financial bearing as the interest earned for the year on his monthly running balances always added to the closing balance of that year. Also, it becomes the opening balance for the following year. Updating of member passbook with interest is an entry process.

- Hence, the fellow does not suffer any financial loss if there is any delay in updating interest in their passbook.

- Further, if a member withdraws his EPF dues before the interest is updated in his passbook, in that case, also, at the time of his claim settlement, the due interest is calculated and paid from the date it becomes mechanically owing by the system.

- Furthermore, in this case, too, there is no financial loss to a member. Meanwhile, the EPFO provided an online facility to submit the joint option form (with employers) to the subscribers to opt for a higher pension until May 3, 2023. Later the time limit was extended until June 26, 2023.

Want to opt for a Higher Pension? Know the Deadline

This month, the labor ministry also clarified that was managed an additional contribution of 1.16 percent of the basic wage for subscribers opting for higher pensions from employers’ contributions to social security organizations run by EPFO.

EPA’s Latest Interest Rate

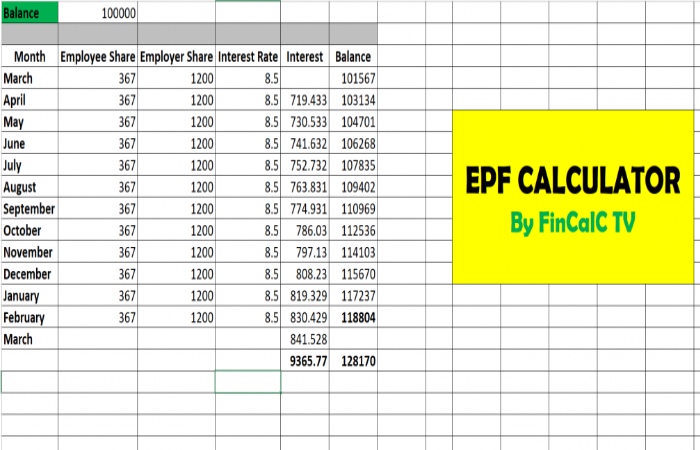

India’s state-run retirement fund manager raised the employees’ provident fund interest rate to 8.15% for FY23. So, it will profit more than 60 million subscribers of Employees’ Provident Fund Organization (EPFO).

Points to Note On EPFO – 2023

The money in the EPF account is sovereign-back, and interest earned is tax-free, subject to particular conditions. It enjoys the Exempt, Exempt, Exempt (EEE) status as contribution deductible from income before tax under section 80C, and the total amount on maturity is also tax-exempt subject to certain conditions. Also, interest grown in the EPF account is exempt from tax subject to certain conditions. Financial experts mainly advise people.

What is EPF Scheme?

EPF is a retirement benefit plan where both employer and employee pay a convinced percentage of the salary.

Who is Eligible to join EPF Scheme?

According to the EPF scheme rule, an employee must join the EPF scheme if his pay is less or equal to Rs 15,000 per month. An employee’s salary is more than Rs 15,000 per month can join EPF scheme if he and his employer.

Does My Employer also Contribute to My EPF Account?

Yes. According to the EPF rules, an employer must contribute to their employee account. Employer has to contribute 12 percent of the salary of an employee. (Salary here is basic plus dearness allowance and retaining allowance.)

Can I Contribute a higher Amount to my EPF Account?

The rules regarding VPF and EPF are the same. Yes, you can contribute higher to your EPF account. And also this is done via Voluntary Provident Fund (VPF). The interest earned and excused from tax.

After one stops working, can they still contribute to EPF?

According to EPFO, employees cannot contribute to an EPF account if they stop working. Any contribution by the member matches with the employer’s share of the gift.

Conclusion

Any employee in India receives the salary after the employer deducts a certain amount of money as of PF(Provident Fund). One force feel that they are not able to spend their cash-in-hand. Both employers and employees contribute 12% of employee’s salary to EPF. However, when a person wants to retire from their job, Employee Provident Fund EPF is one of the main contributions helpful for their living. So, therefore, the Ministry of Labour regulates EPF schemes in India.