Cryptocurrencies Trading: These are virtual currencies. They can be replaced and traded like any other old currency. But they are outside the control of governments and financial institutions.

Many cryptocurrencies are presented, all with their features and application. However, those with the largest market capitalization are, at least for now, a minority that includes bitcoin, bitcoin cash, ether, litecoin, and dash.

Cryptocurrencies can be considered an alternative to traditional currencies, but they were conceived as an entirely conventional payment solution. However, at the moment, a good number of stores accept cryptocurrencies as a form of payment.

Table of Contents

What is Cryptocurrency Trading?

Cryptocurrency trading is guessing the price movements of cryptocurrencies using a CFD trading account or buying and selling the underlying cryptocurrencies on a trading market.

1. CFD Trading on Cryptocurrencies

CFD trading is derivative, allowing you to speculate on the price movements of crypto without owning the underlying ones. For example, you can go long (buy) if you think the price of a cryptocurrency will go up or go short (sell) if you think it will go down.

CFDs are leveraged products, meaning you only need to pay a small initial deposit, known as a margin, to gain total exposure to the underlying market. Your profits and losses are considered based on the full size of your position, so leverage magnifies both your profits and losses.

2. Buy and Sell Cryptocurrencies over a Trading Market

When you buy cryptocurrencies through a trading market, you acquire the crypto. Therefore, you will need to create a trading market account. Contribute the total value of the asset to open a position and store the cryptocurrency tokens in your wallet until you are ready to sell.

Trading markets have a steep learning curve as one must become familiar with the necessary technology and learn how to analyze the data. In addition, many trading markets impose limits on the number of deposits, and the accounts can be costly to maintain.

Crypto Trading vs Crypto Investing

| Type | Crypto Trading | Crypto Investing |

| Time Horizon | Short-term (minutes to weeks) | Long-term (months to years) |

| Goal | Profit from price fluctuations | Grow wealth over time |

| Strategy | Technical analysis, charts, trends | Fundamental analysis, long-term belief |

| Risk Level | Higher due to frequent trades & volatility | Moderate (still volatile but longer holding reduces timing pressure) |

| Effort Required | High – constant monitoring | Low to moderate – periodic review |

| Transaction Frequency | Frequent buying & selling | Infrequent buying & holding |

| Emotional Impact | High stress, fast decisions | More patience-driven |

| Capital Requirement | Can start small but needs active capital rotation | Can invest gradually (SIP-style approach) |

| Examples | Day trading Bitcoin swings | Holding Bitcoin for 5+ years |

How to Invest in Cryptocurrencies?

Investing is to earn money since an amount is used to generate more.

It is the case in the foreign exchange or “forex” market, which is almost identical to the cryptocurrency market. For example, cryptocurrencies with a production limit, such as Bitcoin, which will issue up to 21 million BTC, tend to increase in price over time as they become scarcer

What is the “Holding”?

It is a simple way to invest and buy cryptocurrencies that are rising in value on the market. That is, whose price is growing, and then keep the money quiet in your wallet for a long time until it doubles or triples its initial value. Afterward, it is sold, and thus a good profit is obtained.

This method can take years, but if you want to make profits in less time and frequently, you should dedicate yourself to “trading”; that is, to trade: buy and sell.

What is “Trading”?

With “trading”, the famous phrase is fulfilling “who does not risk losing, does not risk winning either”.

It will not generate income standing. Still, you have to move assets to make profits and do the work of a merchant or “trader”.

A good “trader” is not defined by the surprising increase in their money but by maintaining their growth, no matter how small it may seem. A skill that develops with experience.

To maintain a positive investment rate, avoid using money destined for other purposes and set the amount for your future investments.

Types of Crypto Trading

| Type of Trading | What It Is | Key Features | Resource Link |

| Spot Trading | Buying/selling crypto immediately at current market price | Simple entry/exit; ideal for beginners | https://www.investopedia.com/terms/s/spotmarket.asp |

| Margin Trading | Trading crypto using borrowed funds | Higher profit potential + higher risk | https://www.binance.com/en/margin |

| Futures & Derivatives | Contracts to buy/sell crypto at a future date | Leverage trading; hedging opportunities | https://www.bybit.com/en-US/learn/futures-trading |

| Day Trading | Buying/selling within a single day | Quick trades; relies on market volatility | https://www.investopedia.com/terms/d/daytrading.asp |

| Swing Trading | Holding positions days to weeks to profit from trends | Uses trend analysis; less frequent trading | https://www.investopedia.com/terms/s/swingtrading.asp |

| Scalping | Making many small trades for small profits | High frequency; quick decision making | https://www.investopedia.com/terms/s/scalping.asp |

| Algorithmic Trading | Automated trading using bots & algorithms | Fast execution; rule-based strategies | https://www.investopedia.com/terms/a/algorithmictrading.asp |

| Arbitrage Trading | Profiting from price differences across exchanges | Low risk if executed quickly | https://www.investopedia.com/terms/a/arbitrage.asp |

Is it Profitable to Invest in Cryptocurrencies?

Bitcoin, Bitcoin Cash, Litecoin, Dash, and Ethereum crypto are especially interesting for investors and stock speculators. The reason is simple anyone who bought bitcoin for a few hundred dollars a few years ago is now a millionaire.

While bitcoins are popular, they are also extremely risky for investors. By the end of 2021, cryptocurrencies saw violent price swings in both directions. The bitcoin price rose to a record high of almost $69,000 on November 10 and has since started to plummet.

For some market participants, bitcoin is the new gold. While others see a giant bubble since, unlike stocks, cryptocurrencies have no intrinsic value. Amazon’s stock, for example, is based on the value of the company’s employees and assets, among other things. It is what makes the difference between stocks and cryptocurrencies.

Crypto Trading Tools & Platforms

| Platform/Tool | Type | Key Features | Fees / Price | Resource Link |

| Binance | Exchange | Spot, margin, futures, staking | Trading fees ~0.10% (can be lower with BNB) | https://www.binance.com/ |

| Coinbase | Exchange | Beginner-friendly, secure wallet | ~0.50% + spread | https://www.coinbase.com/ |

| Kraken | Exchange | Spot, futures, staking | ~0.16–0.26% | https://www.kraken.com/ |

| Crypto.com | Exchange/App | Earn interest, card rewards | Fees vary by region | https://crypto.com/ |

| Bitfinex | Exchange | Advanced order types | Maker/Taker fees ~0.10–0.20% | https://www.bitfinex.com/ |

| TradingView | Charting/Analysis | Real-time charts & indicators | Free; Pro from ~$14.95/mo | https://www.tradingview.com/ |

| CoinGecko | Market Data | Prices, volume, alerts | Free | https://www.coingecko.com/ |

| CoinMarketCap | Market Data | Rankings, charts, research | Free | https://coinmarketcap.com/ |

| 3Commas | Trading Bot/Automation | Auto trading bots | Plans ~$14.50–$49.50/mo | https://3commas.io/ |

| Shrimpy | Portfolio Tracker/Automation | Portfolio rebalancing, bots | Plans ~$13–$79/mo | https://www.shrimpy.io/ |

| MetaMask | Wallet | Browser & mobile wallet | Free (network fees apply) | https://metamask.io/ |

| Ledger Nano S / X | Hardware Wallet | Cold storage | One-time: ~₹5,000–₹15,000+ | https://www.ledger.com/ |

| CoinStats | Portfolio Tracker | Multi-exchange sync | Free; Premium ~$4.99/mo | https://coinstats.app/ |

Risk Management in Crypto Trading

| Topic | Explanation | Why It Matters | Best Practice |

| Stop-Loss | Automatically sells asset at a set loss level | Limits downside risk | Set 2–5% (day trading) or based on support levels |

| Take-Profit | Automatically closes trade at target profit | Locks in gains | Use risk-reward ratio (e.g., 1:2) |

| Portfolio Diversification | Spreading investment across multiple coins | Reduces impact of single asset crash | Mix BTC, ETH, stablecoins & selected altcoins |

| Managing Volatility | Handling rapid price swings | Prevents panic decisions | Use position sizing & avoid overexposure |

Regulations & Security

| Aspect | Details | Key Advice |

| Legal Status by Country | Crypto legality varies (regulated in US, UK, AU; restricted in some regions) | Check local government & tax laws before trading |

| Wallet Security | Use hardware wallets for large holdings; enable 2FA | Never share private keys |

| Avoiding Scams | Fake exchanges, phishing, pump-and-dump schemes | Verify URLs, avoid guaranteed returns |

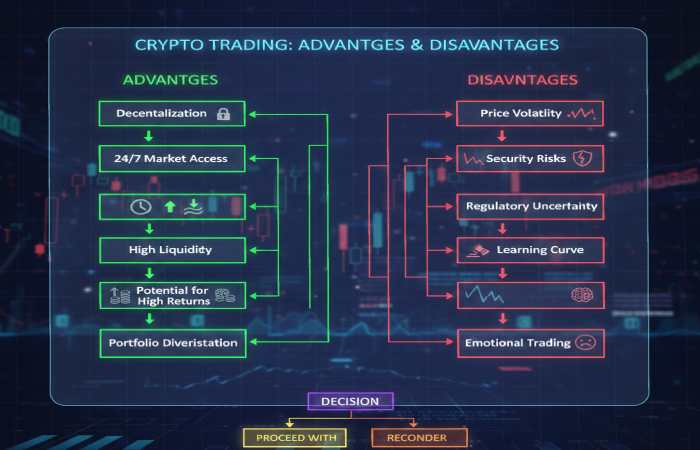

Advantages & Disadvantages

Best Crypto Trading Apps ( Country-wise)

United States — Best Crypto Trading Apps

| App / Exchange | Approx Trading Fees | Key Features | Resource Link |

| Binance.US | Maker 0–0.40% / Taker 0.01–0.60% | 180+ coins, staking options | https://www.binance.com/en-US |

| Kraken | Maker 0.25% / Taker 0.40% | 440+ coins, Pro mode | https://www.kraken.com/ |

| Uphold | ~0.25% stablecoins / higher for alts | 300+ assets, flat fees | https://www.uphold.com/ |

| Crypto.com | Maker/Taker ~0.40–0.60% | 340+ coins, app + card | https://crypto.com/ |

| Coinbase | ~0.50% + spread | Simple interface, trusted brand | https://www.coinbase.com/ |

India — Best Crypto Trading Apps

| App / Exchange | Approx Trading Fees | Key Features | Resource Link |

| Mudrex | ~0.25% maker/taker (low tiers) | 650+ tokens, low fees | https://mudrex.com/ |

| CoinDCX | ~0.20% maker/taker | 500+ coins, futures | https://coindcx.com/ |

| CoinSwitch | ~0.49% maker/taker | Beginner-friendly | https://coinswitch.co/ |

| WazirX | ~0.10–0.20% | 300+ pairs, easy UI | https://wazirx.com/ |

| ZebPay | ~0.45–0.50% | 150+ assets, OTC & lending | https://www.zebpay.com/ |

United Kingdom — Best Crypto Trading Apps

| App / Exchange | Approx | Key Features | Resource Link |

| Coinbase | ~0.50% + spread | Highly regulated, secure | https://www.coinbase.com/ |

| Binance | ~0.10–0.50% | Global tokens & low fees | https://www.binance.com/ |

| Kraken | ~0.25–0.40% | Deep liquidity & many assets | https://www.kraken.com/ |

| Bitstamp | ~0.30–0.40% | Veteran exchange, simple UI | https://www.bitstamp.net/ |

| eToro | ~1% on crypto trades | Social trading & multi-assets | https://www.etoro.com/ |

Australia — Best Crypto Trading Apps

| App / Exchange | Approx Fees | Key Features | Resource Link |

| Crypto.com | Maker ~0.08% / Taker ~0.18% | 400+ coins, AUD deposits | https://crypto.com/ |

| Binance | Varies by volume | Broad token support | https://www.binance.com/ |

| CoinJar | Varies by trade | Australian-friendly, simple app | https://www.coinjar.com/ |

| Kraken | ~0–0.26% fees on Pro | Secure & veteran exchange | https://www.kraken.com/ |

| Coinbase | ~0.50% + spread | Easy for beginners | https://www.coinbase.com/ |

South Africa — Best Crypto Trading Apps

| App / Exchange | Approx Fees | Key Features | Resource Link |

| Luno | ~0.10–0.25% | ZAR deposits, local support | https://www.luno.com/ |

| Binance | Varies by volume | Global markets & many tokens | https://www.binance.com/ |

| Kraken | ~0.25–0.40% | Strong security, global pool | https://www.kraken.com/ |

| Crypto.com | Competitive low fees | 400+ tokens | https://crypto.com/ |

| eToro | ~1% crypto fee | Multi-asset trading | https://www.etoro.com/ |

Getting Started Guide

| Step | Action | Tips for Beginners |

| 1. Learn Basics | Understand blockchain & crypto terms | Start with Bitcoin & Ethereum research |

| 2. Choose an Exchange | Select regulated, secure platform | Compare fees, reviews & supported coins |

| 3. Create Account | Complete KYC verification | Use strong password + 2FA |

| 4. Fund Account | Deposit via bank transfer, UPI, card | Start small to reduce risk |

| 5. Start Trading | Use spot trading first | Avoid leverage initially |

| 6. Secure Assets | Transfer long-term holdings to wallet | Use hardware wallet for safety |

Common Mistakes to Avoid

| Mistake | What Happens | How to Avoid |

| Emotional Trading | Panic selling or FOMO buying | Stick to strategy & risk plan |

| Over-Leveraging | Large losses from small price moves | Avoid margin trading as beginner |

| Ignoring Market Research | Poor entry & exit timing | Use technical & fundamental analysis |

| No Stop-Loss | Unlimited downside risk | Always define risk before entering trade |

| Investing More Than You Can Afford to Lose | Financial stress | Only invest disposable income |

Related Searches

- What is the best time to trade cryptocurrencies

- cryptocurrency market

- how to invest in bitcoin

- invest in cryptocurrencies

- cryptocurrencies to invest

- types of cryptocurrencies

- how the bitcoin market works

Conclusion

Trading cryptocurrencies, also known as cryptocurrencies, involves investing in their piece movements. Using a CFD trading account or buying and selling the underlying on a trading market.